5G launch is taking a high road in Europe. In 2020, we saw commercial rollout of 5G services in various places and Europe is no behind to give its attempts in making this available to a huge population. Now, entering into 2021 could bring multiple opportunities for European operators as they put down their efforts in catching up with other countries to roll out the next-generation superfast 5G networks. In this regard, European Union has come forward to input funds which is one-fifth of its 750 billion euro (i.e., 914 billion USD) extracted from its recovery fund that would ultimately upgrade its digital capabilities. Lack of political clarity due to demands to discard leading equipment supplier Huawei and other vendors, made mobile operators in Europe a bit reluctant to invest in developing 5G wireless networks supporting applications in autonomous vehicles, smart factories and homes, and many more. However, as operators are being encouraged by EU with financial support, they are preparing to stream through the way, accelerating 5G deployments in 2021 across the European countries.

European connectivity in today’s world

Let us have a quick glimpse of how Europe is connected till date. In 2019, total 4G subscriptions in Central and Eastern Europe was only 42%, Western Europe was only 69%. Taking download speed as the benchmarking factor, Sweden was placed 21st among the list followed by Germany 23rd, France 24th, Spain 27th, Italy 33rd and the UK 36th—all with speeds below 30 Mbps.

Currently, Mobile Network Operators (MNOs) are taking multiple steps as they move forward with establishing ultra-fast 5 G wireless networking technology. Development of network infrastructure needs massive upgradation to build seamless connectivity to aid applications and services ranging from intelligent homes, cities to connected cars to digital healthcare etc. It is estimated that 5G could bolster 100 billion devices by the year 2025 where networks are deployed to facilitate 1 million connections in every kilometres of area. To make this happen, operators are constantly deploying 5G cell towers, antennas and other components, with networking technologies, and busy assessing network via 5G test equipment on user KPIs such as download and upload speed, voice calls etc. imparting more connectivity to European cities and towns in the current and years to come.

Which bands are being used for 5G wireless networks in Europe?

Three pioneer frequency ranges (frequency bands) have been harmonised for the 5G deployment covering EU. These are: 700MHz band, 3.6 GHz band and 26 GHz band. Mobile operators are assigned with 700 MHz band to enable wireless broadband services to users covering a wide territorial area that includes rural locations. Facilitation of higher and moderate data-sharing capacity in sparsely and densely populated areas is important where 3.6GHz band and 26GHz respectively will come into play in 5G deployment of this new-age network connectivity. Operators are authorised to use these bands ensuring they have access to essential spectrum bands to allow 5G connectivity and innovative services across the EU.

Is Europe prepared for 5G services on a wider scale?

Europe based operators are on a path similar to the United States and other countries to commercialize 5G in various places across countries. Europe is now being considered as the world’s leader in this field as it has invested €1 billion in European trials creating innumerable business opportunities. Further, more investments amounting to €60 – 100 billion in commercial launch of 5 G networks are yet to come. To facilitate wireless network services in sectors such as broadcasting, environmental protection and energy, transport and public safety research, member states are being encouraged to make critical frequencies available and pave the way for necessary services. Policy makers are serious to enable gigabit connectivity with cross-sector innovation. They are planning for Europe’s digital future by improving investment situations mainly by:

- Organizing public funding programs that will focus on providing digital network infrastructure in the rural areas. Fiber and 5G infrastructure have been identified by European Commission and members states of the EU to support investment in these key areas to impart digital connectivity to remote regions in Europe.

- 5G spectrum frequencies to be considered on priority as COVID-19 already caused delay in 5G deployment. Spectrum auction for 700MHz and 3.5GHz were postponed which ultimately affected commercializing plans of O2 CZ, T-Mobile CZ, and Vodafone CZ. The European Commission recently issued a recommendation to make sure all the member states (27 states) could have a timely deployment with high-capacity infrastructures to support broadband connectivity and coordinate spectrum allocations to get the entire 5G process back on track.

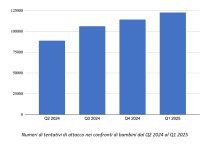

- Implementing 5 G security measures to make sure all no security breaches are there in network. Member states such as Germany, France, Italy etc. have already or are in the verge of adopting measures to ensure an ample amount of cybersecurity is enforced to build superfast wireless networks throughout the EU.

- Additionally, the council asks to reduce deployment costs to member states for deployment of 5 G networks across the Europe.

Conclusion

Radio spectrum bands are the basis of wireless technologies and play a central role in the deployment of 5 G networks. Increase in the rate of connected devices and their usability has imposed huge requirement for connectivity. Taking this into consideration, it becomes critical to harmonise spectrum bands across Europe with few policies in place so that interoperability of infrastructure can be improved with an ability to deliver broad range of services as 5G will bring multiple benefits to sectors such as healthcare where critical emergency needs can be served in presence of excellent network connectivity like 5G wireless networks.

Numerous trials are being performed by operators in the leading four biggest economies in the European Union namely France, Germany, Italy and Spain. Samsung is at the top companies in 5G research making several amendments in to optimize the functionality of 5G networks and make it available to users. Moreover, enhanced 5G capabilities are on the way with network testing conducted rigorously, for e.g., AT&T tested a latest software update on a live 5 G+ network victoriously and resulted in network speeds over 1.5 Gbps.

References –

https://www.ericsson.com/en/blog/2020/7/the-state-of-european-connectivity-how-ready-are-we-for-5g#:~:text=According%20to%20the%20Commission’s%205G,138%20future%205G%2Denabled%20cities.

https://ec.europa.eu/digital-single-market/en/towards-5g

https://www.fiercewireless.com/5g/baker-a-look-at-progress-5g-rollouts-across-europe

https://www.lightreading.com/5g/spectrum-auctions-slowing-europes-5g-progress/d/d-id/764585